The Complete PSLF Limited Waiver Guide

Although the CARES Act payment pause continues to extend the forbearance for student loans, the US Department of Education announced on October 6, 2021, that it would expand the Public Service Loan Forgiveness (PSLF) program. This waiver is designed to give more assistance for federal loans held by federal employees and other public servants. But the limited PSLF waiver is time sensitive– the exemption from the regular requirements of the public service loan forgiveness deadline is October 31, 2022.

This PSLF student loan forgiveness directive benefits both current and former government employees. When applying for PSLF, the Department of Education eliminated some of the usual conditions, such as being in a qualifying repayment program, making payments within 15 days of the due date, or partial payments.

If you are a government employee or work for a non-profit and have a federal student loan, you should explore whether the Limited PSLF Waiver can help you.

Here is a complete guide to the PSLF limited waiver program and some positions in public service that qualify.

Table of Contents

Recent Loan Forgiveness Statistics

Federal Student Loan Forgiveness Requirements

Public Service Jobs Qualify for Loan Forgiveness

PSLF Eligible Repayment Programs

Required Annual Applications

Reconsideration of PSLF and TEPSLF

PSLF and Taxes

Recent Loan Forgiveness Statistics

In the fall of 2017, amid rising student loan debt averages, the Public Service Loan Forgiveness (PSLF) Program began accepting and reviewing applications from borrowers seeking loan forgiveness. The PSLF Program, which was established under the College Cost Reduction and Access Act of 2007, originally allowed Direct Loan borrowers who make 120 eligible monthly payments while working full-time for a qualifying employer to have the remaining balance forgiven.

The Consolidated Appropriations Act, 2018 provided limited, additional conditions under which borrowers may become eligible for loan forgiveness if some or all of the payments made on Direct Loans were under a nonqualifying repayment plan for PSLF. This reconsideration is referred to as the Temporary Expanded Public Service Loan Forgiveness (TEPSLF) opportunity.

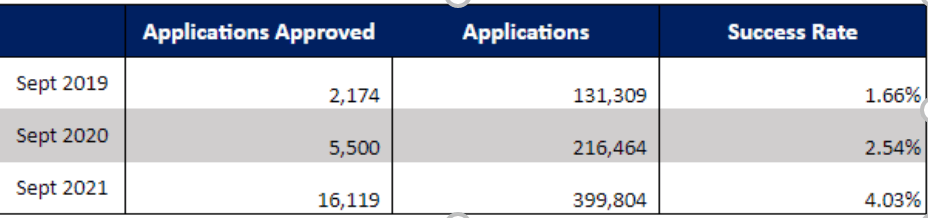

It’s crucial to note that the figures above represent totals dating back to the start of loan forgiveness in October 2017. For example, there were 10,619. not 16,119 debtors who had their loans forgiven from September 2020 to September 2021.

More than 400,000 borrowers with total and permanent disabilities will receive $7.8 billion in loans.

$1.2 billion for borrowers who attended ITT Technical Institutes before the company went out of business; and

Almost $2 billion was paid to 105,000 borrowers who had been scammed by their institution.

Federal Student Loan Forgiveness Requirements

Determining who qualifies for PSLF can be broken down into two aspects: First, are the types of loans which are eligible to count towards the program. Last are the employment qualifications which allow for the payments to be credited towards discharge.

Under normal PSLF rules, after making 120 qualifying monthly payments under a qualifying repayment plan while working full-time for a qualifying company, the PSLF Program forgives the remaining debt on your Direct Loans.

Eligible Loans

Direct Loans

Direct Consolidation Loans

(Special rules exist determining how much credit can be applied to payments by one or both of the participants in a JDCL.)

FFEL loans that are consolidated to Direct Loans PRIOR TO OCTOBER 31, 2022

Ineligible Loans

FFEL Joint Consolidation Loans

As FFEL Joint Consolidation loans are currently not allowed to be reconsolidated into Joint Direct Consolidation loans, they are currently ineligible for consideration for the PSLF Limited Waiver Program. Lawmakers are currently being encouraged to change the law to allow for FFEL participation in the future.

Qualifying Employment

According to studentaid.gov, U.S. federal, state, local, or tribal government agency are considered government employers regarding PSLF. Examples include:

the U.S. military

Law Enforcement

Firefighters

Public schools

public colleges and universities

public child and family service agencies

Public transportation

Utilities

Housing authorities

The PSLF Help Tool was published in December 2018 on StudentAid.gov to assist those seeking PSLF in learning more about the program, determining whether their employment qualifies, and determining what they may need to do with their loans to ensure success.

Servicer Transfers and PSLF Transitions

Recently three servicers announced that they would be exiting the industry.

Granite State (GSMR). Since January 2019, the Consumer Financial Protection Bureau — an agency founded by Warren to protect consumers — has received 56 complaints about the company from borrowers, with the most common issues being inaccurate credit reporting, poor communication, and attempts to collect debt that isn’t owed.

Navient has also been subject to multiple lawsuits. have both announced that they will be exiting the federal student loan servicing industry at the end of 2022.

FedLoan Servicing, the exclusive current PSLF servicer, has announced that they also will not renew their contract at the end of 2022. All accounts currently handled by them will be transferred to various other servicers. MOHELA, Aidvantage (loans previously serviced by Navient), Edfinancial, and Nelnet will receive the loan accounts currently being managed by FedLoan Servicing.

The existing terms, conditions, interest rates, debt discharge or forgiveness programs, or accessible repayment plans on the loans will not be affected by this transition. It will also not affect their borrowers’ present temporary payment suspension and 0% interest perks offered by the CARES Act.

Limited Waiver Rule Changes

The key points are:

-

-

If you have loans through the Federal Family Education (FFEL) Program, Perkins, or other federal student loans, you must combine them into a Direct Consolidation Loan to be eligible for PSLF, both in general and under the waiver.

-

*FFEL TO DIRECT CONSOLIDATIONS MUST BE DONE BEFORE OCTOBER 31, 2022. Check to determine if you work for a qualifying employer before you consolidate.

-

Past payback periods will now be counted whether you made a payment, and whether you made that payment on time, for the full amount due, or on a qualifying repayment plan.

-

Under the waiver, forbearance periods of 12 consecutive months or 36 cumulative months will be counted. ED will begin making account modifications to incorporate these periods in the fall of 2022.

-

These months do not include any forbearance periods offered by the COVID-19 Emergency Relief Flexibilities.

-

The PSLF waiver will count months spent in deferment prior to 2013. On or after January 1, 2013, ED will include Economic Hardship Deferment. These deferment periods will be applied to your account in the autumn of 2022.

-

Defaults and in-school deferments are still not eligible.

NOTE: The requirement for qualifying employment has not changed.

Public Service Jobs That Qualify for Loan Forgiveness

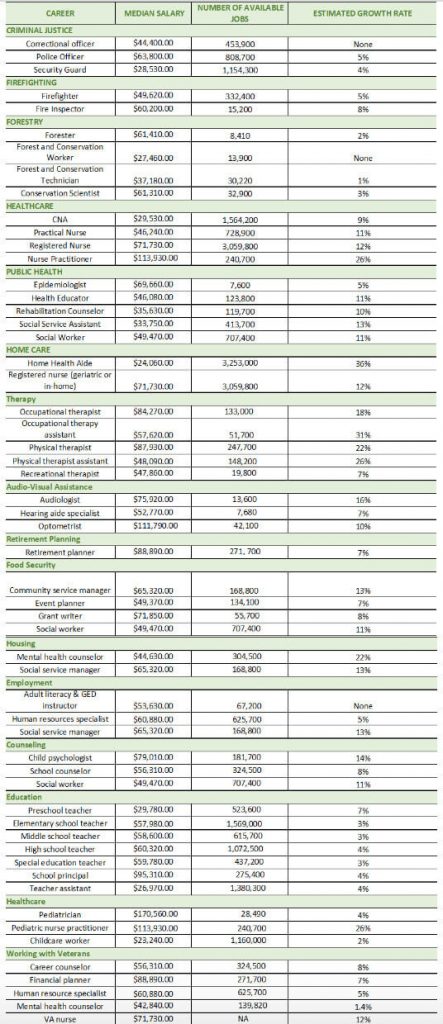

Millions of jobs are eligible for the PSLF program. “There are roughly 35 million PSLF-qualified jobs in the U.S. — 22 million federal, state and local government jobs and 13 million 501(c)(3) jobs,” says Jason DiLorenzo, founder and CEO of PSLFJobs, an employer consultant and jobs platform. “The ‘public service’ sector is much larger than people think.”

“Borrowers must be employed by a U.S. federal, state, municipal, or tribal government or a not-for-profit organization,” according to the Department of Education’s Office of Federal Student Aid website. U.S. military duty is included in federal service.” To be considered for PSLF forgiveness, borrowers must work full-time for one of these organizations.

Labor unions, partisan political organizations, and for-profit businesses (including for-profit government contractors) are excluded from the program.

You must be directly employed by a qualifying employer for your work to count toward PSLF. “If you work for an organization that has a contract with a qualifying employer, your employer’s status — not the status of the organization with which your employer has a contract — determines whether your employment qualifies for PSLF,” according to the PSLF program’s qualifying employer description. “If you’re employed by a for-profit contractor doing work for a qualifying company, for example, your employment does not count toward PSLF.”

PSLF Eligible Repayment Plans

Per studentaid.gov, a qualifying PSLF student loan forgiveness payment is

…a payment that you make after Oct. 1, 2007; under a qualifying repayment plan; for the full amount due as shown on your bill; no later than 15 days after your due date; and while you are employed full-time by a qualifying employer.

Income-driven repayment plans are examples of qualifying repayment plans for PSLF.

-

Revised Pay As You Earn Plan [REPAYE Plan]

-

Pay As You Earn Plan [PAYE Plan],

-

Income-Based Repayment Plan [IBR Plan],

-

Income Contingent Repayment Plan [ICR Plan]

These are plans in which your monthly payment is determined by your income.

Despite the fact that the 10-year Standard Repayment Plan qualifies for PSLF, you will not be eligible for PSLF discharge unless you enroll in an income-driven repayment plan.

For example, if seeking student loan forgiveness for nurses after 10 years of standard payments, they would have no outstanding balance to forgive after making the 240-300 eligible PSLF payments on the 10-year Standard Repayment Plan. Their loans would have been completely paid off during the time they were working toward PSLF.

Income driven repayment plans take into account the income level of the borrower. The salary of a VA-employed physical therapist can still vary tremendously from the salary of a government social worker or the military salary of an oral surgeon.

Required Annual Applications

If you have submitted PSLF annual applications for this year to FedLoan, you may need to resubmit them to Mohela to ensure that they are received and credited to your account in a timely manner. Servicers have had numerous lawsuits leveled against them regarding missing or incomplete recordkeeping and forbearance steering. (Whats forbearance on a student loan?)

Here’s a summary of how to take advantage of the PSLF’s limited waiver

-

Verify your employer’s qualifications.

-

If necessary, consolidate your debts.

-

Understand how the PSLF waiver affects you.

-

Complete and submit the public service loan forgiveness program application.

-

Expect that if you have a federal servicer that is not Mohela, your account will be transferred there once approved.

Reconsideration of PSLF and TEPSLF now Available

-

FedLoan Servicing already has your loans, and

-

You’ve already submitted an authorized PSLF & Temporary Expanded PSLF (TEPSLF) Certification & Application, PSLF application, or employment certification form.

We recommend deferring reconsideration requests until after the Limited PSLF waiver has been applied to your loans, as it addresses many of the challenges borrowers have experienced in the past with program eligibility, and Mohela student loan caseloads are increasing due to the FedLoan transfer.

PSLF and Taxes

Many TitanPrep clients have expressed concern about PSLF discharge. One of the most common questions we receive is “Is PSLF forgiveness taxable?”

Fortunately, discharged loans from the PSLF limited waiver program are not considered taxable by the IRS.

PSLF Assistance

If you properly follow the methods outlined in this article, you may be able to reduce your repayment time or perhaps receive complete forgiveness.

This information is aimed at borrowers who have experienced trouble with the PSLF program when information about the program was few and frequently inaccurate.

Our staff can assist you with not only eligibility questions, but also determining 1) whether this benefit is worthwhile, and 2) how this and other loan repayment options affect your long-term financial goals. We also have an A-Rating with the BBB and a solid 4.9 on Google reviews.

Also, share this PSLF guide your friends about the news, since no matter what occurs, a large number of deserving public servants will be left out simply because they didn’t know and failed to apply.

Leave a Reply